Raiffeisenbank (Bulgaria) EAD Lead Manager for West – East Bank’s AD initial bond issue

05 July 2006

Raiffeisenbank (Bulgaria) EAD was the Lead Manager for the first unsecured corporate bond of West – East Bank AD, the youngest bank on the Bulgarian market. With a coupon of 6-month EURIBOR+0,75bps, the EUR5m 3-year Floating Rate Note was competitively priced.

During their initial offering the bonds were privately placed with institutional investors. Subject to the approval from the Bulgarian Financial Supervision Commission, the bonds will be offered for public trading on the Bulgarian Stock Exchange – Sofia AD. The bond has been issued for general financing purposes of the bank.

West – East Bank AD is the youngest financial institution on the Bulgarian market, which is specialized in corporate banking. West – East Bank is a member of Nova Ljibljianska Banka Group, which has EUR 12 bln. assets under management.

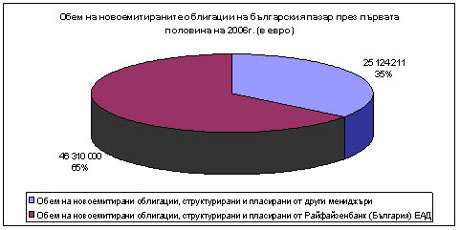

For the first six months of 2006, Raiffeisenbank (Bulgaria) was Lead Manager of 7 new bond issues, at the amount of EUR 46,3 mln., corresponding to market share of 65%.

Raiffeisenbank (Bulgaria) EAD was the Lead Manager for the first unsecured corporate bond of West – East Bank AD, the youngest bank on the Bulgarian market. With a coupon of 6-month EURIBOR+0,75bps, the EUR5m 3-year Floating Rate Note was competitively priced.

During their initial offering the bonds were privately placed with institutional investors. Subject to the approval from the Bulgarian Financial Supervision Commission, the bonds will be offered for public trading on the Bulgarian Stock Exchange – Sofia AD. The bond has been issued for general financing purposes of the bank.

West – East Bank AD is the youngest financial institution on the Bulgarian market, which is specialized in corporate banking. West – East Bank is a member of Nova Ljibljianska Banka Group, which has EUR 12 bln. assets under management.

Raiffeisenbank (Bulgaria) EAD Lead Manager for West – East Bank’s AD initial bond issue.

With the successful completion of this 31st transaction, Raiffeisenbank (Bulgaria) EAD has once again confirmed its leading position in the Bulgarian debt market. In the period 2003 – until now, Raiffeisenbank structured and placed a total bond volume of EUR240m.